National Insurance Scheme Grenada

Moving Ahead Responsibly to Secure Our Tomorrow

NIS Benefits at a Glance

Maternity Benefit

This benefit is payable to insured women before or after childbirth, or to insured husbands in specific circumstances.

Learn More

Employment Injury Benefit

Paid to insured persons, including the self-employed, who suffer injury, illness, or death due to job-related incidents.

Learn More

Funeral Grant

A one-time payment to help cover the funeral expenses of an insured person, spouse, or child.

Learn More

Age Benefit

A pension or lump-sum payment to insured individuals who have reached retirement age and meet contribution requirements.

Learn More

Invalidity Benefit

This benefit is provided to insured persons who are permanently unable to work due to illness or injury and meet qualifying conditions.

Learn More

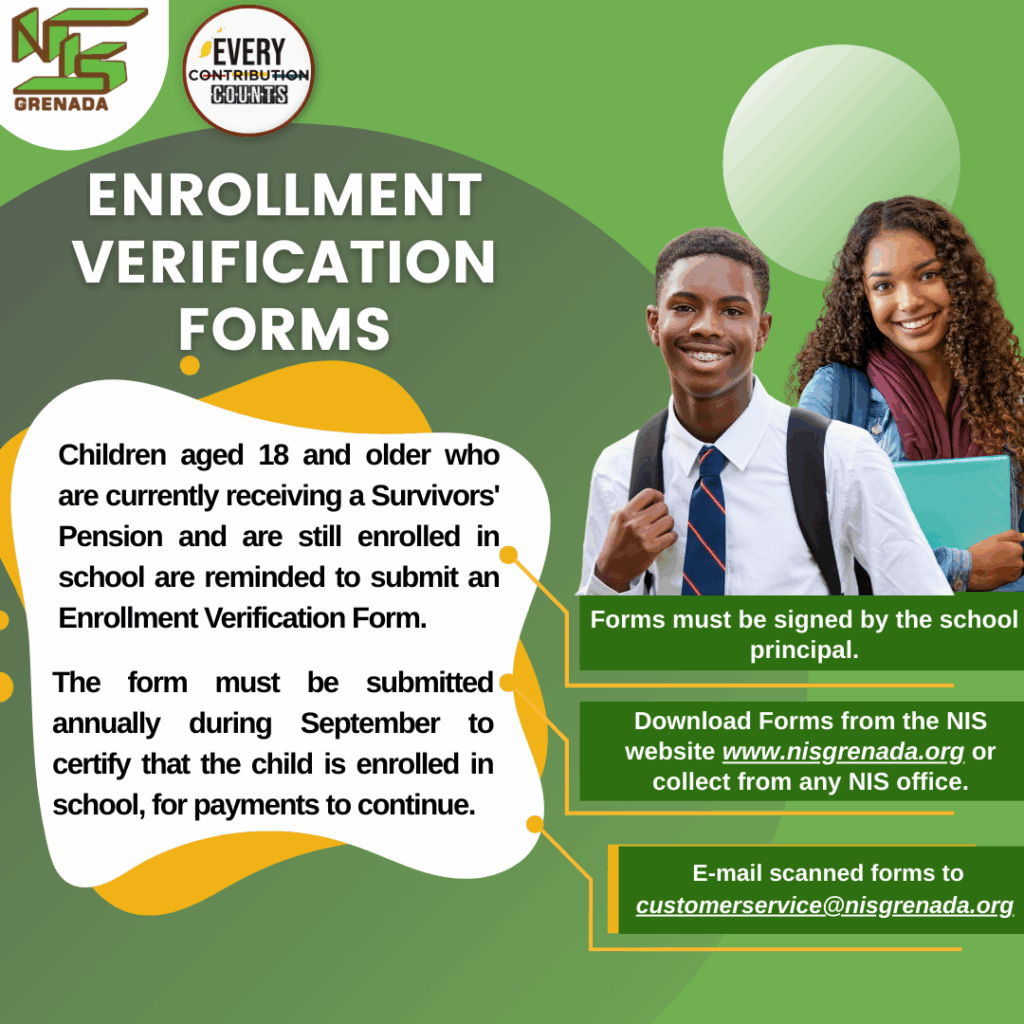

Survivors Benefit

Paid to the widow, widower, dependent children, or dependent parent of a deceased insured person.

Learn More

Unemployment Benefit

Available to insured individuals who are temporarily unemployed, offering financial assistance while they seek new employment.

Learn More

Sickness Benefit

Designed to supplement lost wages for insured persons who are temporarily unable to work due to illness.

Learn More

Reciprocal Agreement

Ensures that contributions and benefits are recognized across participating CARICOM countries, allowing mobile workers to maintain coverage.

Learn More

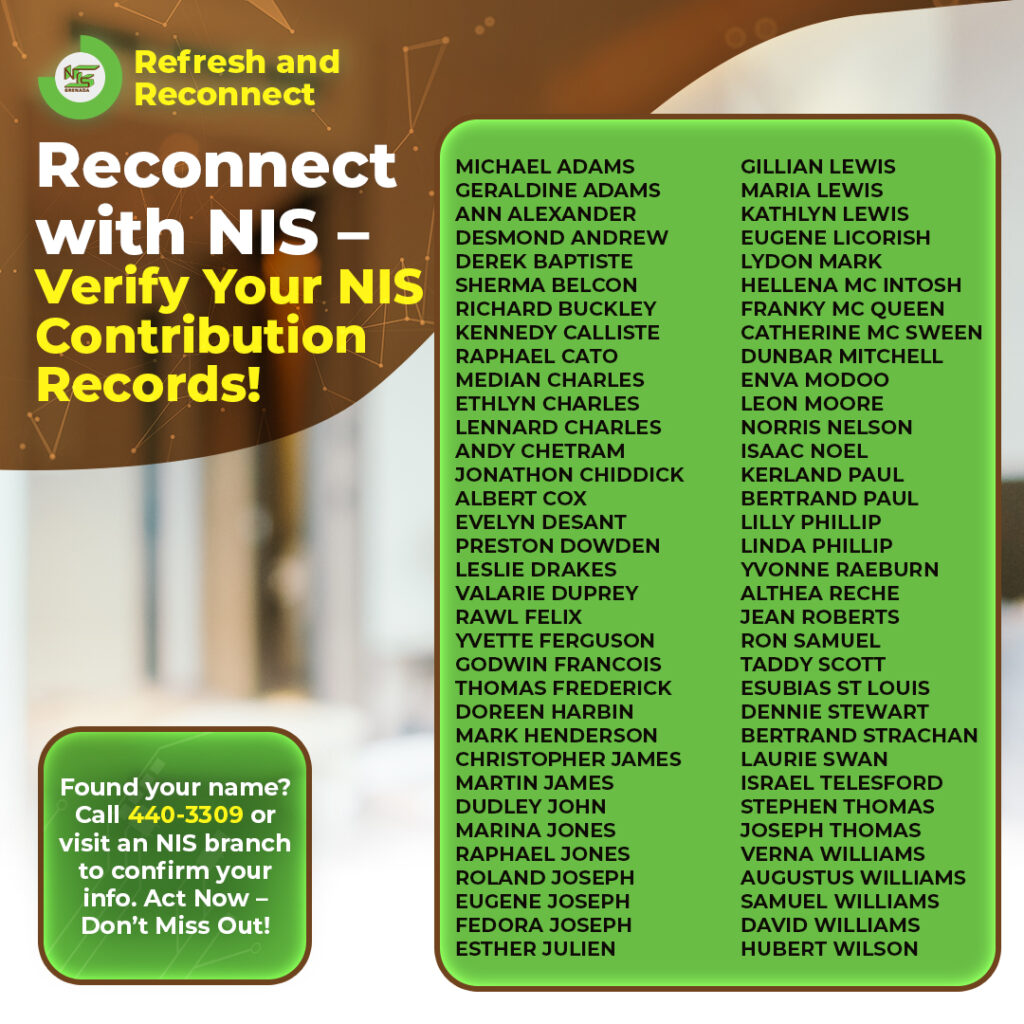

Contributors

All employed and self-employed persons in Grenada are mandated by the National Insurance laws to register and pay contributions. In this section the contributors are broken down into four sections: Self-employed, Voluntary, Employee and Employer.

- Employer

- Employee

- Voluntary

- Self Employed

Employer

An employer is a person or corporate body with whom an employee has entered into a contract of service or apprenticeship expressed or implied whereby such a person or corporate body is liable to pay salary, wages or other remuneration for services performed by the employee.

Employee

All Employees are required to register with the NIS and pay contributions. To register an employee must submit his or her certified birth certificate, a valid picture ID and all other relevant supporting documents where necessary (marriage certificate, deed poll, proof of citizenship, etc.). All employees should present their NIS card to their employer upon commencement of employment.

Voluntary

A voluntary contributor is someone who is between ages 16 and the pensionable age (currently 63), and while not employed or self-employed, wish to continue to have contributions paid on their behalf.

Self Employed

All self-employed persons are required by law to be registered with the NIS and to pay contributions. The contributions rate for a self-employed person is 13.5% of gross earnings. Self-employed persons over the age of 65 are required to pay 1% of gross earnings for employment injury benefit. The maximum earnings on which contributions are payable is $5,200.00 per month

Effective July 1, 2023, new Self-employed regulations were introduced. Under these regulations, Self-employed persons can:

Choose to pay monthly or in lump sums annually.

- Pay any amount between $907 and $8,424 annually to qualify for all NIS benefits (including Sickness, Maternity, Unemployment and Employment Injury Benefits).

- To qualify for benefits the following year you it is mandatory to contribute in the current year (must contribute in 2026 to qualify for benefits in 2027).

- Enjoy the advantage of no penalties and interest for late payment

- Make self-employed payments even when employed elsewhere (provided that contribution payments amount to no more than $8,424 a year).

Remit, Submit & Track Online

Your National Insurance services—now online.

Employers and employees can now submit contributions, view statements, and manage NIS records all in one secure platform.

- Fast

- Easy

- Paperless

Access everything, anytime at my.nisgrenada.org

Support you with 19 Essential Benefits

The National Insurance Scheme offers 19 benefits across long-term, short-term, and employment injury categories—supporting workers, families, and businesses across Grenada.