National Insurance Scheme Grenada

Moving Ahead Responsibly to Secure Our Tomorrow

Pension Life Certificate Form

Annual Reports

Employer/ Employee/ Self-Employed Handbook

Benefits

01

Maternity Benefit

This benefit is payable to insured women before or after confinement or to a husband…

02

Employement Injury Benefit

Employment Injury Benefit is paid to insured persons (including the self-employed) who are in…

03

Funeral Grant

Funeral Grant is a one-time payment intended to assist with the funeral expenses of:…

04

Age Benefit

Age Benefit is a payment made to an insured person who has attained the…

05

Invalidity Benefit

Invalidity Benefit is paid to a person who has exhausted his or her entitlement…

06

Survivors Benefit

Survivors Benefit is paid to the widow/widower, children and a dependant parent of an…

07

Sickness Benefit

Sickness Benefit is designed to supplement wages lost by an insured person who is…

Contributors

All employed and self-employed persons in Grenada are mandated by the National Insurance laws to register and pay contributions. In this section the contributors are broken down into four sections: Self-employed, Voluntary, Employee and Employer.

- Employer

- Employee

- Voluntary

- Self Emplloyed

Employer

An employer is a person or corporate body with whom an employee has entered into a contract of service or apprenticeship expressed or implied whereby such a person or corporate body is liable to pay salary, wages or other remuneration for services performed by the employee.

Employee

All Employees are required to register with the NIS and pay contributions. To register an employee must submit his or her certified birth certificate, a valid picture ID and all other relevant supporting documents where necessary (marriage certificate, deed poll, proof of citizenship, etc.). All employees should present their NIS card to their employer upon commencement of employment.

Voluntary

A voluntary contributor is someone who is between ages 16 and 60, and while not employed or self-employed, wish to continue to have contributions paid on their behalf.

Self Employed

All self-employed persons are required by law to be registered with the NIS and to pay contributions. The contributions rate for a self-employed person is 11% of gross earnings. Self-employed persons over the age of 60 are required to pay 1% of gross earnings for employment injury benefit. The maximum earnings on which contributions are payable is $5,000.00 per month

Remittance & eSubmission

Remittance and e-submission in one convenient location.

About nis

The National Insurance Scheme pays eighteen (18) benefits in three categories: long-term, short-term and employment injury. The long-term benefits are: Age, Invalidity and Survivors (Spouse, Child, Dependent Parent). The short-term benefits are: Sickness, Maternity (Allowance/Grant), Funeral (Insured, Spouse, Child) and Employment Injury. The employment injury benefits are: Injury, Medical Expenses, Disablement, Constant Attendance and Death Benefit (Spouse, Child, Dependent Parent, Other Dependents).

Press / News

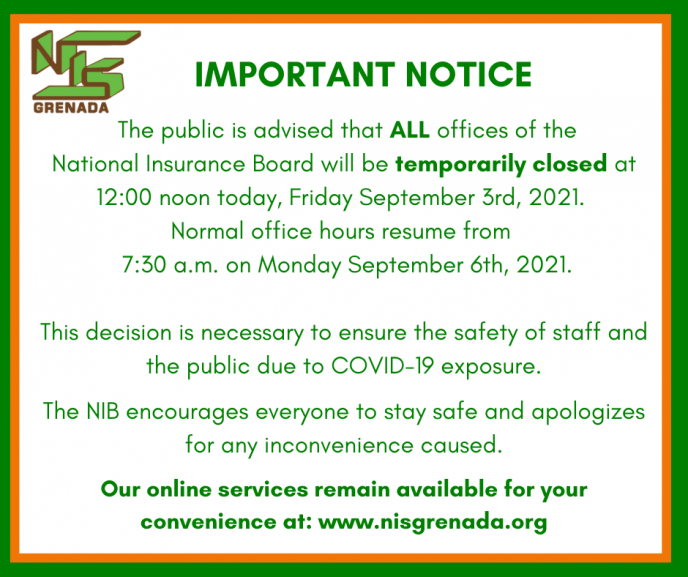

Temporary Office Closure Notice

07 Sep 2021

Please take note of the following temporary closure notice.Customers are encouraged to access NIS services…

Carriacou Sub-Office Closure

06 Sep 2021

Dear Valued Customers of Carriacou & Petite Martinique.Please take note of the following.

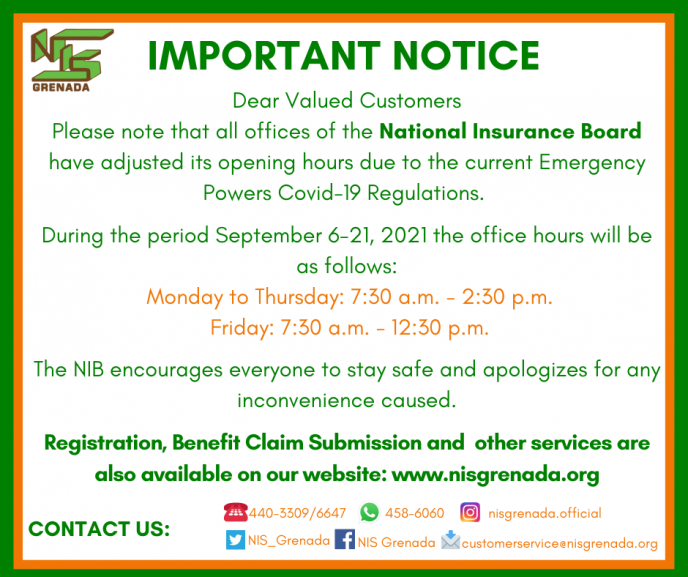

Adjusted Opening Hours

03 Sep 2021

Dear Valued Customers,Please take note of the following.Remember to utilize NIS online services at: www.nisgrenada.org…

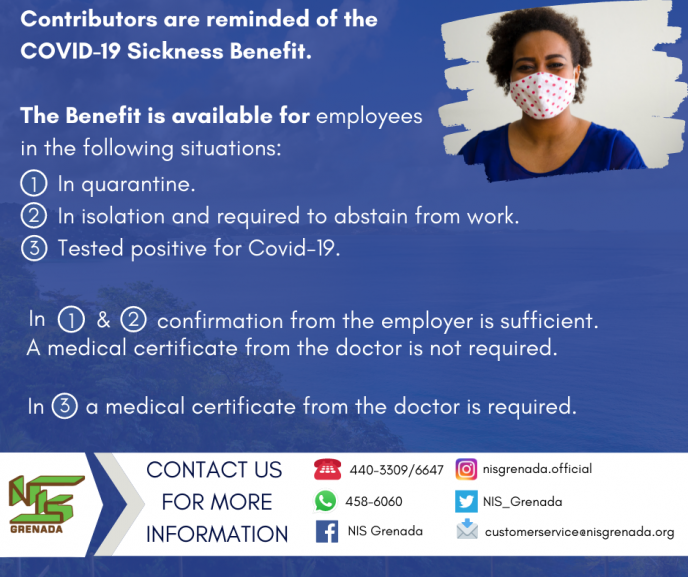

COVID-19 Sickness Benefit

25 Aug 2021

Click on the link to download the COVID-19 Sickness Claim Form. https://bit.ly/3rTgNXH

Request fot Quotation: Retro-fitting of NIS Sub-Office Ariza Business Complex, Carriacou

25 Aug 2021

REQUEST FOR QUOTATION: RETROFITTING OF NIS SUB-OFFICE – ARIZA BUSINESS COMPLEX, CARRIACOU The National Insurance…

Interested in learning more?

Get in touch now!

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.