Mortgage

Mortgage

Who is eligible to apply for a mortgage loan at the NIS?

To be eligible for a mortgage loan at the NIS you must be:

- An NIS contributor between the ages of 21 and 60.

- The applicant or at least one of them must be resident citizen of Grenada.

For what purposes I can get a mortgage loan from the NIS?

You can get a mortgage loan for any of the following purposes:

- Construction, home repair/re-model.

- Purchase of property (includes land only).

- Refinancing and debt consolidation.

What documents are required?

Applicants for mortgages must submit the following documents:

- Evidence of a purchase/sales agreement for the property which he/she intends to purchase with the proceeds of the loan together with a copy of the vendor’s property tax receipt and title deed; or

- Evidence of ownership of, or title to the land on which he/she intends to build a house or carry out home improvement with the proceeds of the loan.

- A plan approved by the Land Control Development Authority.

- Proof of income (recent pay slip & job letter)

- Loan statements.

- Two forms of picture ID.

- Statement showing the ability to make the 10% equity contribution.

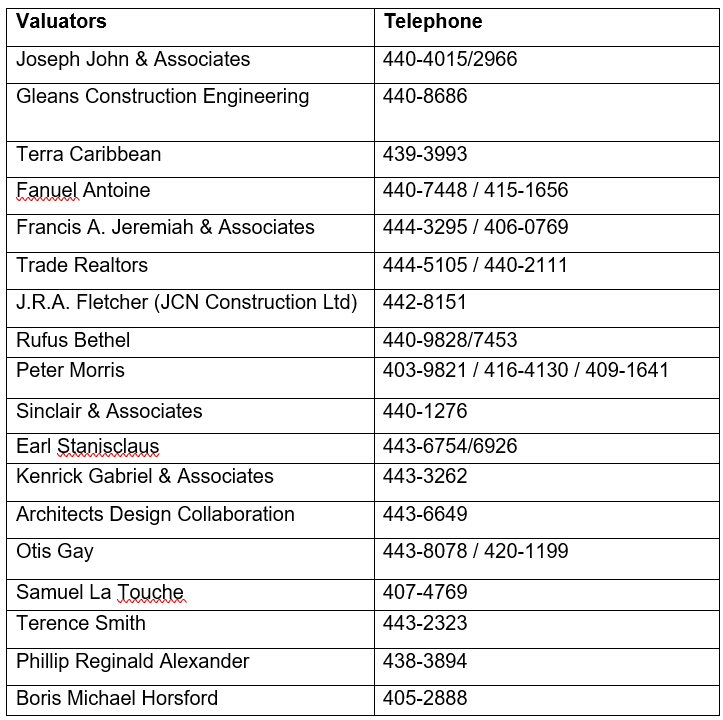

Valuators

Valuation of the property and estimated cost of construction or repairs, must be done by one of the following valuators approved by the NIB: